Inheritance tax paid on what you leave behind to your heirs, and they could pay as much as 40% tax on what they inherit. The good news is that there are lots of ways to cut down your bill, which we’ve explained in full in our guides to inheritance tax.

Accounting

Payroll

Bookkeeping

Auto-Enrolment

Taxation

Self-Assessment

VAT

Making Tax Digital

Certainty

Wills

Probate

All Materials

Articles

Calculators

Documents

Newsletters

Stamp Duty Land Tax Calculator

Stamp Duty Land Tax (SDLT) is a tax on properties bought in England and Northern Ireland.

Directors National Insurance Calculator

Directors‘ national insurance. A director’s NI normally calculates differently to that of a normal employee which always calculates on a non-cumulative basis.

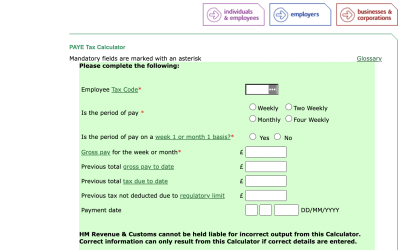

PAYE Calculator

Use this calculator to calculate your take home salary. It will show you PAYE, NI and Net Salary.

Estimate Income Tax Calculator

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year.

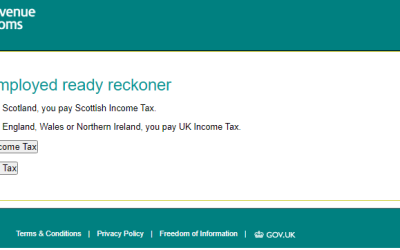

Self-Employment Ready Reckoner

If you are self employed, you can use the HMRC self employed ready reckoner to help budget for your tax bill.

National Insurance Calculator

If you’re an employee, you’ll need to pay Class 1 NICs on your earnings. This National Insurance Calculator can help you work out what that contributions should be.